Croatia and Australia sign historic first tax treaty

- by croatiaweek

- in Business

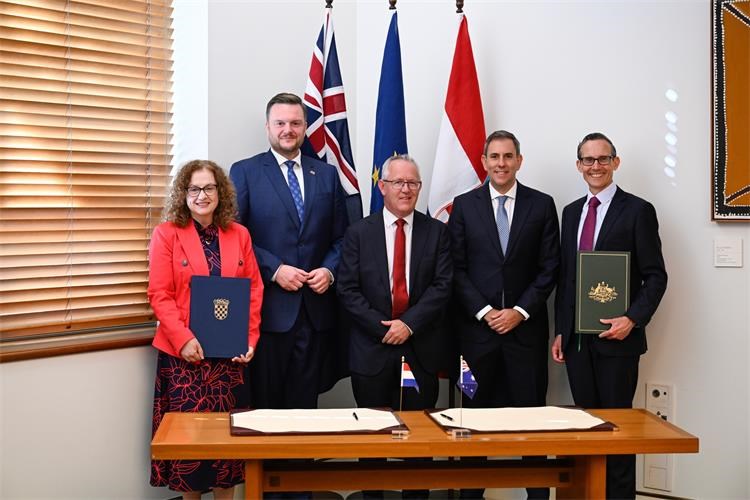

(Photo credit: Ministry of Finance)

Australia and Croatia have taken a historic step in strengthening their economic ties with the signing of their first-ever bilateral tax treaty.

The agreement, signed in Canberra today by Croatia’s Deputy Prime Minister and Minister of Finance, Marko Primorac and Australia’s Assistant Minister for Productivity, Competition, Charities and Treasury, Dr Andrew Leigh, marks a significant milestone in the relationship between the two countries, paving the way for smoother trade and investment.

Once fully ratified by both parliaments, the treaty will eliminate double taxation on income and introduce clearer rules for businesses and individuals operating across the two jurisdictions.

For companies, it promises a more predictable environment, reduced costs and simpler compliance, all of which are expected to boost confidence and encourage greater commercial activity.

Two-way trade between Australia and Croatia reached around AUD 328 million in 2024, with investment flows totalling approximately AUD 67 million, particularly in retail and tourism.

The new treaty is anticipated to deepen these ties further, creating fresh opportunities for cooperation, innovation and economic growth.

Key to the agreement is the reduction of withholding tax rates. Dividends will generally be taxed at a maximum of 10 per cent, with a lower 5 per cent rate available to companies with substantial shareholdings.

Certain government entities, central banks, Croatian pension funds and Australian superannuation funds will be exempt from withholding tax altogether.

Similar reductions apply to interest and royalty payments, making it cheaper for both Australians and Croatians to access each other’s capital, technology and intellectual property.

The treaty also introduces clear rules on pensions, ensuring non-government periodic pension payments are taxed only in the recipient’s country of residence.

Lump-sum pension payments, however, may still be taxed at source in defined circumstances. These provisions aim to provide certainty for retirees while preventing tax avoidance.

The agreement preserves the right of both countries to enforce their domestic anti-avoidance laws.

It also aligns with OECD and G20 global standards on combating profit shifting, reinforcing the Albanese Government’s commitment to ensuring multinational companies pay their fair share of tax.

Other notable elements include strong rules against discriminatory tax treatment, improved mechanisms for resolving tax disputes and modern standards for information exchange between tax authorities.

More details about the treaty can be found here.