Crypto market in Croatia: Why is Bitcoin not widely talked about after 2017 even though the price is close to $20,000?

- by croatiaweek

- in Business

With the exponential development of technology, almost every day we have the opportunity to see innovations that bring wealth to many, wealth that they could only dream of. The innovation that has made the most “random” millionaires is certainly the blockchain, with the emergence of cryptocurrencies. Chances are you’ve heard of the most famous cryptocurrency, Bitcoin. In today’s article, find out how Bitcoin is compared to the Croatian kuna, and Why is Bitcoin not widely talked about after 2017 even though the price is close to $ 20,000?

After it was created in early 2009, Bitcoin was mostly considered counterfeit internet money that, like many others before it, would fail in the short term. This thesis ignores the fact that Bitcoin uses blockchain technology that distinguishes it from all assets that existed until then.

Blockchain allows Bitcoin to be decentralized, transparent, and secure, and one of the most appealing things about this cryptocurrency is the absolute control that the owners have over their funds.

Sure, this is all appealing to “tech-savvy” people, but why has Bitcoin become so popular with the general public?

The answer is…profits on the price growth, of course.

Bitcoin has grown tremendously since its emergence. Although there is no precise data on the value of Bitcoin, during 2009 its price was very close to $ 0. In 2010, a Bitcoin auction took place. That auction has been frequently mentioned in the crypto community lately due to an absurd price difference.

In March 2010, a member of the BitcoinTalk forum, “SmokeTooMuch” offered through auction his 10,000 Bitcoins for sale for $ 50. It’s not clear if he managed to sell them, but then forum members offered him $ 25 for 10,000 Bitcoins, deeming them worthless. If someone has managed to buy the said Bitcoins and has not sold them in the meantime, he is a very lucky man. 10,000 Bitcoins today are worth around $175 million, or 1 billion and 120 million Croatian kunas.

Source: BitcoinTalk

Since the emergence of Bitcoin, the kuna has lost 12.9% of its value

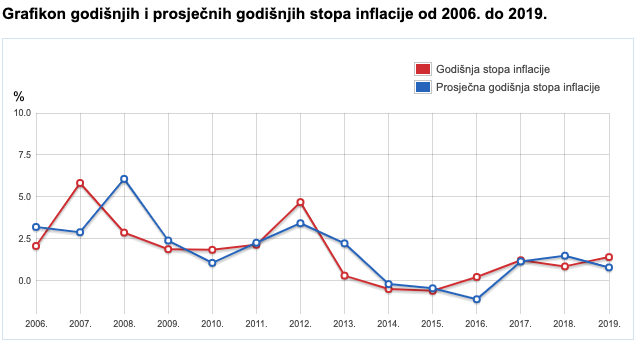

The value of national currencies varies constantly, mostly due to inflation, which most people do not take into account. Inflation is the decline in the purchasing power of a particular currency over time. A quantitative estimate of the rate at which purchasing power declines may be reflected in an increase in the average price level of a “basket of selected goods and services” in the economy over a period of time. An increase in the general price level often expressed as a percentage, means that a unit of currency effectively buys less than it did in previous periods.

Source: DZS Simply put, with the same amount of kuna over time you can buy fewer goods. According to the Croatian Central Bureau of Statistics, since the creation of Bitcoin until today, the Croatian kuna has lost 12.9% of its value, which is not insignificant. In that same period, the price of Bitcoin rose by more than 350,000,000%. Apart from the growth in popularity, the fact that goes in favor of this cryptocurrency is that it is not subject to inflation. There is a finite number of Bitcoins that will ever exist, and that is 21 million. Currently, 18.5 million are available, and the last Bitcoin will be “mined” in 2140.

Why is no one talking about Bitcoin at the moment?

During 2017, the entire cryptocurrency market experienced incredible growth, which was buzzed by almost all Croatian and world media. Then many invested in Bitcoin, and after it reached a price of $ 20,000, a steep decline began. Belief in cryptocurrencies then declined, and in the last two years, the market has had numerous ups and downs, until a few months ago.

After a long wait, the Bitcoin-led cryptocurrency market has finally woken up and started a bull run. Only this time the story is somewhat different. Although the price of Bitcoin has jumped to almost $ 18,000, no one is talking about it in mainstream media.

This time, the biggest role in price growth was played by global financial institutions, which, after thorough research, concluded that Bitcoin is a quality investment and that they should have it in their portfolio. An increasing number of “celebrities” in the financial world are deciding to invest in Bitcoin. A recent example is one of the world’s most respected hedge fund managers, Stanley Druckenmiller. The general public has not yet joined this “bull run” and it is believed that the “hype” about Bitcoin and cryptocurrencies is just beginning.

A study conducted by one of the world’s largest investment funds, Fidelity Investments, found that portfolios holding a larger share of Bitcoin outperformed their less diversified counterparts. The Fidelity report further assessed the potential redistribution of investments from alternative investments and fixed income to Bitcoin.

The stock market is estimated at $ 13.4 trillion, so if Bitcoin occupied 5% of this market, its market capitalization would increase by $ 670 billion. If it took 10%, the market capitalization would increase by $ 1.3 trillion. The bond market is worth approximately $ 50.3 trillion. If Bitcoin occupied 1% of that market, that would mean an additional $ 500 billion. While this is an over-optimistic scenario in our eyes, it is potentially feasible in the long run.